FHB Mobile and FHB Online Upgrade

Say YES to an improved FHB Mobile Banking and Online Experience

FHB Mobile app and FHB Online® Upgrade is Completed

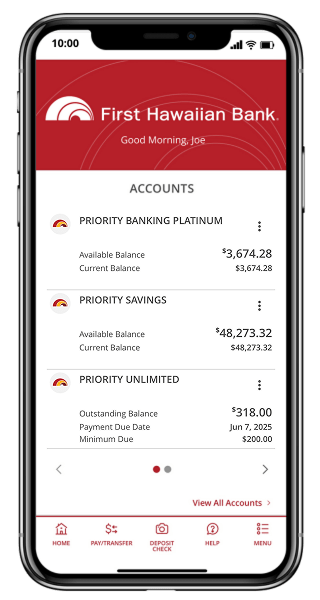

The FHB Mobile app[[#1]] and FHB Online[[#2]] has been upgraded to bring you a new, seamless online banking experience whether you access your accounts on your desktop, mobile phone or tablet. You'll still have the features you're accustomed to, along with new features that will let you bank online with ease across all versions of the service.

Key Information About the Upgrade

- Your current Username and Password will NOT change.

- You will need to update to the new version of the FHB Mobile app after the upgrade.

What's New with the FHB Mobile App

A New User Experience

Enjoy a cleaner, more intuitive design that makes it easier to find what you need, whether you're banking on mobile or desktop.

Expanded Capabilities

Now you can do even more in the app:

Secure Messaging - Contact us safely through in-app chat or messages.

eStatements[[#3]] - Enroll, view, and manage your delivery preferences.

CD Management - Renew certificates directly in-app.

Bill Pay[[#4]] - Enroll or unenroll with just a few taps.

Check Reordering - Order replacements without leaving the app.

Credit Card Redemption - Manage your rewards quickly and easily.

Small Business Entitlements[[#5]] - Assign and manage user roles and access.

More Features Coming Soon

This upgrade makes it easier for us to bring you new and improved digital banking features, on both desktop and mobile, so you can enjoy a more seamless experience wherever you bank.

Updated Financial Tools

Use the new My Money[[#6]] widget (formerly "Manage Your Finances") to keep track of your accounts. Linked accounts and configured budgets will carry over from the previous service, and you will now be able to see merchant names and icons for transactions (if applicable). Categories will also display to help sort your spending.

New Cash Flow and Debt Tools Coming to Mobile

You will be able to better understand historical spending and view all your outstanding debt in the app.

Discontinued Features

The Goals feature (Desktop), and Insights feature (Mobile), previously available with Manage your Finances, will no longer be available in My Money.

FAQs

Didn’t find an answer? Still have questions?