Transfer Money

Quickly transfer money between your First Hawaiian Bank accounts and your accounts at other banks[[#1]]

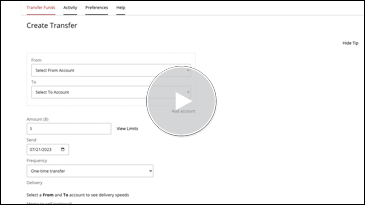

Transfer money online

Transferring money has never been easier. Use your FHB Online Banking® account or FHB Mobile[[#2]] app to transfer money between your First Hawaiian Bank accounts or to/from your own accounts at other financial institutions.

Types of Transfers

-

Internal Transfers

Transfer money between your FHB checking and savings accounts, or from your FHB credit card or line of credit to your FHB checking or savings account. -

External Transfers[[#1]]

Transfer money from an FHB savings or checking account to your account at another bank, or from your account at another bank to an FHB savings, checking, credit card, mortgage, loan or line of credit.

- Make an FHB Payment

Make a payment from your FHB checking account to your FHB credit card loan, line of credit or mortgage account. - Future-Dated Transfers

One-time internal or external transfer that is scheduled up to one year in advance. - Recurring Transfers

Recurring transfers are for the same amount and between the same accounts.

Limits & Processing Times

- Internal Transfers

Up to the current available balance or credit balance in the source account. Internal Transfers made by 10pm HST (business days) will be processed the same business day (10pm ChST if your account was opened in Guam or Saipan). For all mortgage and credit card accounts, and accounts opened online, the cutoff time is 10pm HST. - External Transfers

When creating an external transfer your current External Transfer limits can be viewed by clicking the 'View Limits' link next to the dollar amount you are sending. The expected delivery date is displayed as you are creating the transfer.

Ready to get started?

Enrolling in online banking is easy and takes just a few minutes.

FAQs

Didn’t find an answer? Still have questions?