FHB Online

Conveniently and securely access your accounts at home or on the go with FHB Online Banking

Bank on your terms

With FHB Online®[[#1]] you’ll have a wide range of tools and features at your fingertips so that you can quickly and securely manage your finances. No matter where you are, First Hawaiian Bank makes it easy for you to view your accounts, monitor your transactions, and much more.

Online banking services

Helpful features and tools

Manage Your Finances[[#4]]

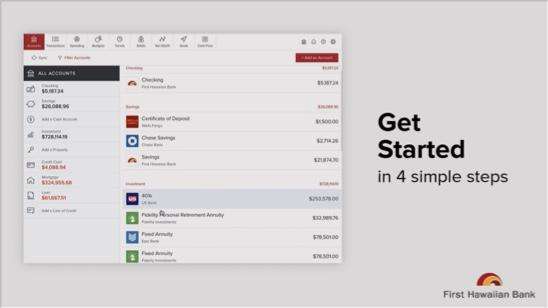

Get a 360° view of your finances and monitor investments, manage your budget and track spending in your accounts, even those at other financial institutions.

Transfer Money [[#5]]

Transfer money to or from your First Hawaiian Bank accounts, including making payments to an FHB credit card, mortgage, loan, or line of credit.

Bill Pay [[#6]]

Easily manage and pay all of your bills from one place, and set up AutoPay to automatically pay recurring bills.

Zelle[[®]][[#7]]

A fast and easy way to send and receive money with people you trust.

Alerts & Notifications[[#8]]

Stay up-to-date on your accounts & transactions with email, SMS or push notifications.

Ready to get started?

Enrolling in online banking is easy and takes just a few minutes.

FAQs

Didn’t find an answer? Still have questions?

Disclosures

View Terms and Conditions

- Basic online banking services including, account aggregation (connecting non-FHB accounts), transfers, mobile check deposit, eStatements, Zelle® and Direct Connect are free for personal customers. Additional fees may apply for optional services such as Online Bill Pay. Businesses may choose between FHB Online Business Basic, our free version, and FHB Online Business Banking, which includes Bill Pay, Zelle® and Entitlements and is $5.99/month (fee waived for Priority Banking customers). See FHB Online Terms and Conditions for additional information about FHB Online services and fees.

- When you enroll in eStatements, you will no longer receive paper statements. If you choose to receive both paper and eStatements, a fee of $5 will be imposed each month per checking and savings account.

- To use eBills you must have a FHB checking account and be enrolled in FHB Online Bill Pay with a biller/payee that offers eBills. Enrollment in Online Bill Pay, may cause you to incur additional fees. See the Terms & Conditions for more details about digital banking services and applicable fees. To unenroll from the Bill Pay service, log in to your FHB Online account and go to Settings then select "Unenroll from Bill Pay".

- To view accounts from another financial institution, you must have online access set up at that institution.

- Restrictions may apply. You can only transfer money between your own bank accounts at FHB or between your FHB accounts and your own accounts at other financial institutions. You must be 18 years or older to use External Transfer services. See Terms and Conditions of FHB Online Services for details.

- Personal customers enrolling for Online Bill Pay must be 18 years or older and may incur additional fees. FHB Online Business Banking includes Bill Pay and Zelle®. Business Online Basic users that enroll in Bill Pay will be automatically upgraded to Business Online Banking. See Terms and Conditions of FHB Online Services for details.

- Must have a U.S. bank account and mobile number to use Zelle®. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Personal customers enrolling for Zelle® must be 18 years or older. Business customers must be enrolled in FHB Online Business Banking to use Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. See Terms and Conditions of FHB Online Services for details.

- Standard SMS/Text Message fees may apply.