Protect Your Credit & Debit Cards

5 min read

Posted on Dec 14, 2022

Features to Protect Your Credit and Debit Cards

All First Hawaiian Bank credit and debit cards provide the following security features:

Fraud Alerts[[#1]]

- When our system detects suspicious activity on your credit or debit card account, First Hawaiian Bank will send you an automated text message and/or email.

- If we have contacted you about a valid transaction, confirm that you authorized it and continue using your account normally.

- If we have contacted you about a fraudulent transaction, respond to us quickly and we will restrict further activity on your account. We will also put you in touch with our team of fraud specialists.

- Fraud alerts from FHB will NEVER ask you for personal information (Social Security Number, date of birth, etc.) unless you initiate contact with us, and then to verify your identity.

Card Alerts

- Using the FHB Mobile App, you can also sign up to receive Card Alerts, user-defined card account and transaction alerts that we will send to you, via text and/or email. Among other things, you can choose to receive alerts when contact information on your account is updated, when a new card is requested or activated, and when your card is used for certain activity, like making out-of-state or out-of-country purchases. These types of alerts can help you monitor for unexpected, potentially fraudulent activity on your account.

- You can start or stop Card Alerts at any time.

- Please consult our Card Alerts FAQ

Free card replacement in the event of fraud or theft

- If you are ever the victim of fraud or theft, we will replace your card for free.

- Call us immediately at 844-4444 (toll-free at 1-888-844-4444) if you need a replacement card.

- Please note that if you have not been the victim of fraud or theft, but have only lost your card, replacement fees may be applicable.

EMV chip technology

- All FHB credit and debit cards issued in 2018 or later are equipped with embedded EMV chips, which provide you with an extra layer of security when you use your card.

- The embedded EMV chip in your card generates a unique, one-time code for each transaction. This code makes it more difficult for fraudsters to counterfeit your card.

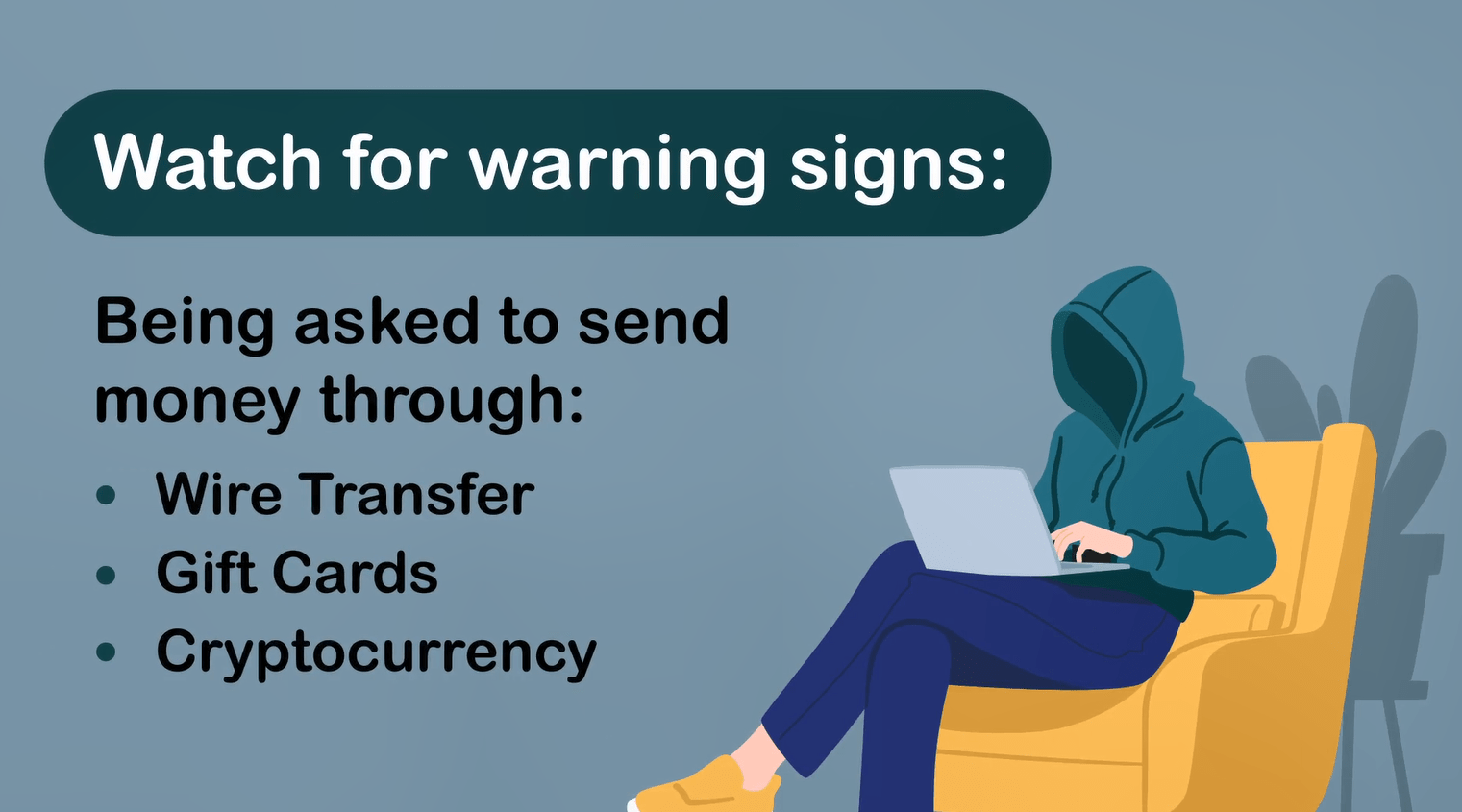

Phishing: A Growing Threat

Be cautious when receiving text messages, emails, or phone calls purporting to be from First Hawaiian Bank. If you have any doubt about the legitimacy of such a communication, do not respond and do not provide any personal or financial information. Call the customer service number on your statement or on the back of your credit, debit, or ATM card if you suspect any fraudulent activity.

Security Precautions for Everyone

To protect your bank accounts, credit cards, and debit cards, remember to do the following:

- Report lost or stolen cards and checks immediately

- Review account statements carefully. Ask about suspicious charges. Do not hesitate to contact us if you see charges on your account that you did not make.

- Do not print your Social Security Number on your checks.

- Store new and cancelled checks in a secure place.

- Cut up expired bank and credit cards, and dispose of them promptly. If you are certain that you will not use them, cancel unused bank and credit cards, cut them up, and dispose of them immediately.

-

Keep your ATM Pin secure

-

Do not use obvious or easily obtainable information as your PIN (e.g. your birth date or part of your Social Security Number)

-

Avoid writing down your PIN

-

Never share your PIN with anybody

-

-

Minimize the chance of mail theft by doing the following:

-

Know your billing and statement cycles. This way, you can let us know quickly if you have not received a statement.

-

Retrieve incoming mail promptly

-

Do not place outgoing mail containing sensitive information in your mailbox. Deposit mail in a U.S. Postal Service mail box or at a post office.

-

-

How to report suspicious activity:

-

Oahu: 844-4444

-

The Neighbor Islands, Mainland U.S., Guam, and CNMI: 1-888-844-4444

-

Disclosures

- First Hawaiian Bank Fraud Alerts program. If First Hawaiian Bank detects potentially fraudulent activity on your credit or debit cards, we may send you notification via email or text message. Text messages to customers based in the United States will be delivered from a short code number (47230) and will be free to the end user. Text messages to customers based in Guam, Saipan or other U.S. territories will be delivered by a 10-digit long code (1-808-207-7990); message and data rates may apply. Message frequency may vary. If you have questions about your text plan or data plan, please contact your wireless provider. You may opt out of receiving fraud alert text messages by replying “STOP” to a fraud alert text message. If you do so, you will get one additional confirmation message stating that you’ve opted out and will no longer receive fraud alert text messages from First Hawaiian Bank. If you change your mind and want to receive fraud alert texts again, please text “START” to the applicable code above. For help with fraud alert text messages, reply with the keyword “HELP” or call us at 888-844-4444. Carriers are not responsible for any delayed or undelivered messages. Messages may be delayed or not delivered due to factors outside of the carrier’s control. Information obtained from you through our fraud alert short code program will not be shared with any third parties for their marketing purposes. For additional privacy information, please review the First Hawaiian Bank Short Code Privacy Policy.

Was this helpful?

Thank you for the feedback