Identity Theft & Fraud on the Rise: How to Protect Yourself

8 min read

Posted on Apr 21, 2023

Identity fraud is one of the fastest-growing criminal enterprises to impact financial services in recent years. In 2021, identity fraud resulted in $52 billion of losses affecting 42 million U.S. consumer victims, according to a 2022 Identity Fraud study by Javelin.

As the world is becoming increasingly digital and connected, more personal information now resides online. As a result, the likelihood for identity theft and fraud to occur have dramatically increased. With personal information on social media being publicly accessible, it is simple for cybercriminals to use this information to craft targeted attacks, also known as spear-phishing, to defraud victims.

Preventing identity theft and fraud starts with education. First Hawaiian Bank is always here to support your security education needs. Consider these security topics to help protect yourself and your loved ones.

What is Identity Theft and Fraud?

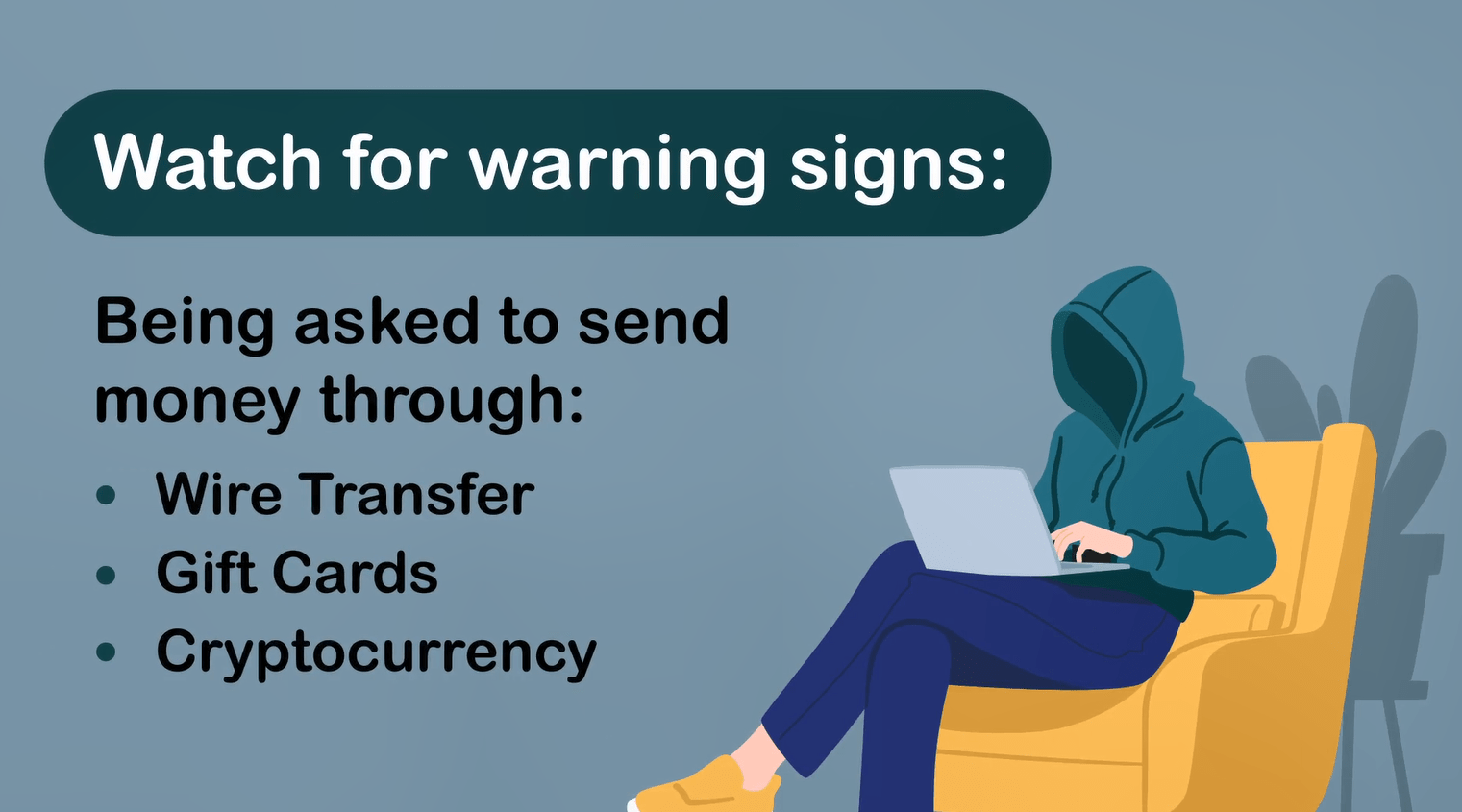

Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses a victim’s personal data in some way that involves fraud or deception, typically for economic gain. Fraudsters usually obtain personal information through purchasing stolen records from successful data breaches. They may also deploy social engineering tactics to trick victims into disclosing their personal information, like through a phishing email, call, or text.

Hawaii reported 12,051 complaints of identity theft in 2021, almost a 9-fold increase from 2019, according to the Insurance Information Institute. In banking, this may take the form where criminals:

- Open a new bank account or falsely applying for loans and credit cards using your name and credit history.

- Add themselves as co-owner on your bank account, before draining your account.

- Withdraw counterfeit checks, in your name, from your bank account.

- Use your stolen credit card information to make online purchases.

How can I protect my personal information?

Protecting your identity starts by keeping your personal information safe. Be sure to:

- Use a strong, unique password for each of your online accounts. One way to create a strong, unique, and easy to remember password is to make a passphrase by combining a sentence or multiple unrelated words. Incorporate a combination of symbols, upper and lowercase letters, and numbers into your passphrase. For example, “I love to eat cookies at night, 1983!” would result in a password of, “Iltecan,1983!”. A password should not include all or part of your real or username, or to something that can be tied to you, e.g., SSN, phone number, birth date, or a relative’s name, etc.).

- Enable multi-factor authentication (MFA) on all your online accounts. MFA requires other security components to login to your account, such as a code sent to your email or the acceptance of a notification, beyond a username and password. Even if your credentials were exposed, MFA provides an extra layer of security that would make it more difficult for cybercriminals to access your account.

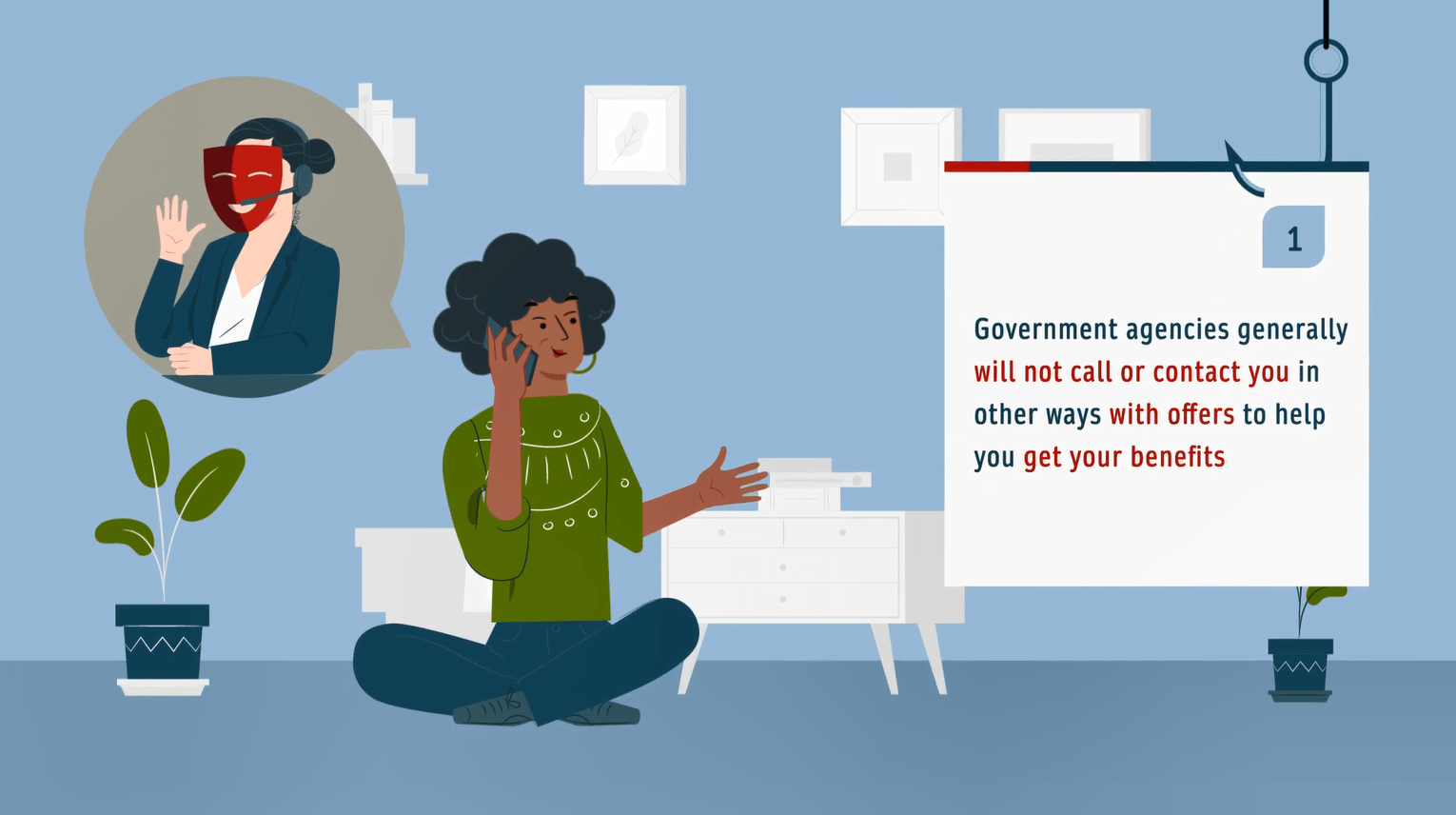

- Remember, most legitimate businesses, including banks, would never ask for personal information over the phone, text, or email. If you receive an unexpected message from a “bank” asking for your account number and password, immediately alert your real bank to the scam. As a precaution, your bank can place a fraud alert on your account.

- Turn on automatic updates on your personal devices. Companies release software updates to remediate vulnerabilities discovered over time. Keep your devices up to date can help protect you as vulnerabilities increase in number and complexity.

- Store your personal information in a safe place. Never share your sensitive information with anyone or keep personal information in plain view. Save physical files under lock and key and encrypt digital files. When no longer needed, dispose of data appropriately: shred paper documents and destroy unerasable mediums such as hard drives and CD/DVDs. Additionally, consider opting for paperless bank statements to eliminate the need to keep track of, store, and shred documents.

- Check to see if you have been compromised. There are publicly available breach checkers (such as this: https://haveibeenpwned.com) that you can search through to review your accounts. If you discover that your identity has been breached, remember to change your password immediately, review your account for suspicious activity, and report it to local authorities immediately if your account was compromised.

What are some other ways I can prevent theft/fraud?

Other ways you can prevent fraud include:

- Regularly monitor your credit card and bank account statements for any unusual activity. You can keep tabs on your FHB online or mobile banking accounts by enabling alerts. If you suspect any fraudulent activity on your account, immediately report the suspicious or unusual transactions to the bank.

- If your credit or debit card was lost or stolen, report it immediately.

- Before you go on a trip, make sure to place a travel notice on any cards you may use.

- Review your credit report at least annually. Check to see if the report lists any suspicious transactions and new accounts you didn’t open. You are legally entitled to one free credit report from each credit bureau every 12 months from annualcreditreport.com.

- When browsing the internet, especially if you are making purchases, ensure the website you are visiting is legitimate and has “https” in the URL. The “https” at the beginning of a URL indicates that nearly all information sent between you and the website is encrypted. Once you’ve made your online purchase, be sure to end your session by logging out of the website.

FHB.com has “http” at the beginning of the URL

What should I do if I suspect I am a victim of identity theft or fraud?

If you suspect you are a victim of identity theft or fraud, it is imperative that you act quickly. Call the relevant parties, which may include your bank, credit bureau, and law enforcement.

If your First Hawaiian Bank account is involved, report the scam to us immediately at 808-844-4444 (toll-free at 1-888-844-4444) or visit the nearest branch to help ensure the security of your account.

Where can I find more information?

You can find more resources about security and fraud protection on our website: Security & Fraud Protection.

Non-FHB Resources:

- Preventing and Responding to Identity Theft | CISA

- What To Know About Identity Theft | Consumer Advice (ftc.gov)

- Identity Theft | USAGov

- What’s the Difference Between Identity Fraud and Identity Theft? | McAfee Blog

- How to Safeguard Personally Identifiable Information (dhs.gov)

Was this helpful?

Thank you for the feedback