Personal Banking FAQs

General

- To check your balance by phone, call your branch at the number listed on your statement or our 24/7 automated voice service at 808-844-4444 or toll-free at 1-888-844-4444. You can also log in to FHB Online Banking or the FHB Mobile app to quickly, and conveniently view your account balances at any time. To enroll, go to fhb.com/enroll or download the FHB Mobile app.

To update or reset your PIN, please do one of the following:

- Reset your PIN in the FHB Mobile App

- Login to your FHB Mobile App and select your credit card or the checking account associated with your debit card

- Tap 'Account Details’

- Tap ‘Manage Card Account’

- Select ‘Set Up PIN’ from the drop-down menu

- If you know your current PIN and would like to change it, you may also contact (808) 844-4321 or 1-800-545-6300. You will be asked to identify yourself using your current PIN before you can reset your PIN.

- Contact FHB Customer Service Daily 7AM – 7PM HST at (808) 844-4444 or Toll-Free (888) 844-4444

When opening a new credit or debit card account, your PIN will be mailed to your mailing address on file. It will be mailed separately from your card for security purposes and should arrive a day or two after your new card is received.

If you have not received your PIN after more than the timeline above, please contact FHB Customer Service Daily 7AM – 7PM HST at (808) 844-4444 or Toll-Free at (888) 844-4444 or visit the nearest branch for assistance.

There are many ways, including:

- FHB Online® - transfer funds between First Hawaiian Bank accounts, to accounts at other financial institutions or to accounts belonging to other people. In addition, if you sign up for the optional Bill Payment feature, you can pay all of your bills online in one place.

Note: Some features have additional fees. See terms & conditions for details.

- Cash withdrawals from First Hawaiian Bank ATMs and other ATMs

- Transfers between linked accounts at First Hawaiian Bank ATMs

- Make purchases at participating merchants using your debit card

- Personal checks

- Transactions with a branch teller

Additional transaction fees may apply. Refer to the disclosures you received at account opening or inquire at a First Hawaiian branch.

- To check your balance by phone, call your branch at the number listed on your statement or our 24/7 automated voice service at 808-844-4444 or toll-free at 1-888-844-4444. You can also log in to FHB Online Banking or the FHB Mobile app to quickly, and conveniently view your account balances at any time. To enroll, go to fhb.com/enroll or download the FHB Mobile app.

To avoid holds, you can use:

- Direct deposit: You can avoid having a hold placed on your check by using direct deposit instead. If you have recurring income like a paycheck, pension payment or Social Security check, arrange to receive it by direct deposit.

- Cash deposits made at a teller window are usually made available no later than the next business day.

A hold means that although we’ve received your check for deposit, you won’t be able to use the funds until the hold period has expired. Depending on the type of check that you deposit, funds may not be available until the third business day after the day of your deposit. However, the first $225 of your check deposits will be available on the first business day after the date of your deposit. If the deposited item is returned unpaid before the hold expires, those funds will not be made available to you. If the deposited item is returned after the hold expired, we charge your account for the amount of the item. Holds are placed to help protect both you and us from losses that could occur when a deposited item is returned unpaid. Situations that typically cause a check to be held include:

- There is reason to believe the funds may be uncollectible

- The source of the check (e.g., foreign checks)

- The account is a new account (new account rules apply for the first 30 days the account is open)

- The account has repeated overdrafts in the last 6 months

- You deposit checks totaling more than $5,525 on any one day

- Fraud is suspected

- Emergency situations, including computer or communication failure. Incorrect routing or account number information on a deposit slip

The speed with which we make your deposited funds available depends on a number of factors, including how, when, and where you made your deposit. For example:

- Direct Deposit: First Hawaiian Bank credits your account on the day the deposit is scheduled to occur. In most cases, a direct deposit is the fastest and easiest way to get funds into your account. Also, direct deposits are free.

- Wire Transfer: First Hawaiian Bank credits your account the day we receive it. Wire transfers typically have to be set up for each transfer. In most cases, there is a fee for sending or receiving a wire transfer, but it can be worth the expense since you know the money will be there when you need it.

- Cash with a Teller: Funds are available no later than the next business day.

- Checks: A hold may be placed on your deposit, depending on the type of check. If you're not sure, ask your teller when the funds you deposited will be available.

To make a deposit by mail, send your check(s) to your branch of account. Please use our branch locator to find your branch of account’s address. Please do not mail cash.

- In FHB Online & Mobile Banking, you can use External Transfers to transfer money to your FHB checking account from your accounts at another bank. Learn more about External Transfers.

- The FHB Mobile app allows you to mobile deposit checks up to $10,000 per business day into your FHB checking account. Learn more about Mobile Deposit.

- Cash, check, and coin deposits are accepted at all First Hawaiian Bank branches. Please see a teller to conduct your deposit.

- Cash and check deposits are accepted at most First Hawaiian Bank ATM’s.

- Wire transfers are accepted into personal and business accounts; however incoming wire fees may apply.

- Electronic Funds Transfers (EFT’s) such as direct deposits from employers or other businesses are accepted into personal and business accounts at no charge from First Hawaiian Bank.

- Check deposits are accepted via mail to your branch of account. Please allow additional time for processing delays due to mail time.

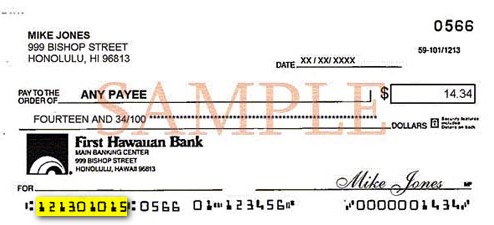

The sample check graphic below shows where the ABA routing number can be found on your check. The routing number is the first nine digits on the bottom left hand side of the check.

An Item Enclosure fee is charged when you receive a copy of your canceled checks with your statement. You may request to be added onto CheckStorage to avoid the Item Enclosure fee by contacting our customer service line at 1-888-844-4444.

A Check Image Service fee is charged for returning images of your canceled checks with your monthly statement. You can receive an online version of your statement which includes images of your canceled checks at no cost. To enable eStatements, login to FHB Online Banking and select your account, then click the Online Statement link. Follow the prompts on the screen to enable eStatements for each of your accounts. To enroll for FHB Online, go to fhb.com/enroll. Learn more about eStatements.

- You can request a stop payment on a personal check at any branch or by calling 1-888-844-4444.

You will need to provide the following information:- Check number and/or amount

- Check Stop Payments - Unless removed, this order will expire 6 months from today.

- Recurring EFT Stop Payments - Unless removed; this order will remain indefinitely

Please note that all the information provided by you must be exactly correct or the stop payment may not be effective. This order will not be effective if the bank has already cashed the item or is already committed to honor the item. A stop payment cannot be placed on an item that has already been presented. A fee of $30.00 will be charged to your account for this stop payment.

- To check your balance by phone, call your branch at the number listed on your statement or our 24/7 automated voice service at 808-844-4444 or toll-free at 1-888-844-4444. You can also log in to FHB Online Banking or the FHB Mobile app to quickly, and conveniently view your account balances at any time. To enroll, go to fhb.com/enroll or download the FHB Mobile app.

A scheduled transfer is a way of automatically moving money from your checking account to another checking or savings account each pay period.

To set up your Automatic Transfers, simply sign in to FHB Online service and click the "Transfer Funds" tab at the top of the page. Or, you can visit your nearest branch, where an associate will be happy to assist you.

You can enroll in Mastercard's ID Theft Protection by clicking "Activate Now" on the page here.

Direct Deposit

There is no charge for direct deposit. First Hawaiian Bank’s direct deposit is free of charge. No fee to setup direct deposit to any of your First Hawaiian Bank personal accounts - checking, savings, or money market account.

With your First Hawaiian Bank account number and the bank’s routing number or a voided check, go to your employer or the funding entity and request direct deposit. Most direct-deposit requests can be implemented by your next payday.

Direct deposit automatically places your paycheck, pension, Social Security, or other regular monthly income into your checking, savings, or Money Market account. It's convenient, secure, and saves trips to your branch.

Online Checking & Savings Account

You should have received an email notification with a link to “Verify Deposits”. You will be taken to a page where you will need to verify your identity. Once verified, you will be asked to enter the two small deposit amounts you received in your external account to complete the verification process. If you need additional assistance, please call us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST.

Please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday thru Friday between 8am – 5pm for assistance with your application.

Please confirm that the checking or savings account you are funding from has a higher available balance than the total deposit amount for your new account(s). If it doesn’t, you can either choose to fund from your account at another bank or by mailing in a check. If your current available balance is higher than your funding amount and you are still receiving an error, please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST for assistance.

Once your new checking or savings account is opened online, you can enroll for and login to FHB Online Banking to view your new account and the full account number. You also receive a confirmation email with a link to view your new account(s). You will be taken to a page where you will need to verify your identity. Once verified, you can view detailed information about your new account(s).

Please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST for assistance with opening a personal checking, savings or eCD account online.

If you ordered checks or a debit card when you opened your new account online, they should arrive within 10-12 business days to Hawaii, Guam or Saipan addresses.

If your account has already been opened and you want to order checks for the first time, please call our customer service at (888) 844-4444.

If you do not remember if you chose to order checks or a debit card during the online account opening process, please refer to your confirmation email with the link to view your account(s). From there, you will be taken to a page where you will need to verify your identity. Once verified, you can view detailed information about your new account(s) including if checks or a debit card was ordered. If you need additional assistance, please call us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST.

Yes-Check[[®]]

Yes-Check links your First Hawaiian Bank checking account to a line of credit – and automatically transfers available funds when your checking account doesn't have enough money to cover your transactions. This service gives you the flexibility to make payments when you don't have enough money in your checking account at the time of the transaction.

Yes, if the available balances in your checking account and Yes-Check are not enough to cover an item, you may be still be charged an Overdraft Fee (OD) or Non-Sufficient Funds (NSF) Return Item Fee.

No, you must apply for a separate Yes-Check line of credit for each checking account.

Please see a Customer Service Representative at a First Hawaiian Bank branch for current Rates and Fees.

You can apply for Yes-Check by visiting any First Hawaiian Bank branch.